El libro que acaba de publicar tiene pinta de ser interesante, recopila escritos y conferencias de estos 10 años de Fundsmith.

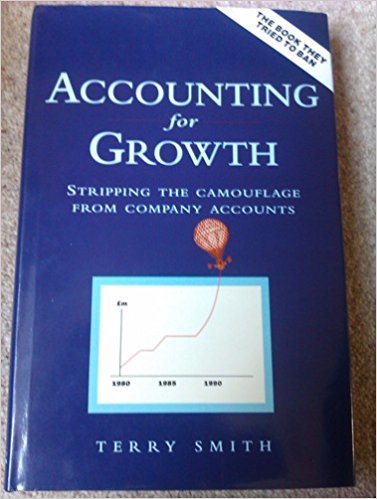

Además de Fundsmith, Terry tiene una larga trayectoria en el mundo de las finanzas, en 1992 publicó su libro Accounting for Growth

The first publication of the book in 1992 caused up an uproar in the City and beyond, and as a result of it many of the practices identified by Terry Smith have been changed or discontinued.

Además de los libros están las cartas que recomiendo leer, están en su web oficial y no son muy largas:

https://www.fundsmith.co.uk/analysis

Comparto algunas líneas que me parecen interesantes remarcar para entender su filosofía.

It is becoming clear that dividends are likely to provide a more significant portion of the total return on equities in the future than they did in the equity bull markets of 1982-2000 and 2003-07.

Every piece of research I have encountered and all my experience shows that frequent dealing is the enemy of a good investment performance.

The only people who want to deal more frequently than daily are hedge funds, high frequency traders, algorithmic traders and idiots (these terms are not mutually exclusive). Why join them? If you don’t want active management, and mostly you shouldn’t, buy an index fund.

Comentario sobre un movimiento de venta, no hacen muchos cambios en cartera:

The only voluntary turnover during the year were sales of our holdings in Kimberly-Clark Corporation (…). Kimberly-Clark began to show adverse results from our regular calculation of the incremental return on capital. We sold the shares at a small profit. They have subsequently performed poorly in terms of fundamental performance although the share price has ironically been quite firm. We prefer to judge our investments by what is happening in their financial statements than by the share price.

Sobre la importancia que se le da al precio, con matices:

Ultimately, of course, a focus on share price movements must be correct. It is no use owning shares in good companies if the strength of their business is never reflected in the share price, but a continuous focus on share price movements to the exclusion of the underlying fundamental economics of the companies is neither healthy nor useful. In the long term one will follow the other, and it is not the fundamentals which will follow the share price.

I have been asked far more frequently whether a share, a strategy or a fund is cheap or expensive than I am asked about what returns the companies involved deliver and whether they are good companies which create value or not.

Sobre eventos macro y otras inversiones value es crítico en el sentido de que si inviertes en un sector cíclico que está deprimido debes acertar con el timing, sino corres el riesgo de estar esperando mucho tiempo al cambio de ciclo mientras estás invertido en empresas destructoras de valor para sus accionistas (lo que recuerda a Cobas, Azvalor y similares), y si aciertas luego tienes que volver a buscar el siguiente sector.

I remain amazed (I could stop this sentence there) by the number of commentators, analysts, fund managers and investors who seem to be obsessed with trying to predict macro events on which to base their investment decisions. The fact that they are seemingly unable to predict events does not seem to stop them trying.

En referencia a no ir cambiando de estrategia, o de fondo, cuando otros lo estén haciendo mejor:

Our inability to take a really long-term view, particularly through the periods when our chosen strategy and companies are not performing as well as less good companies, which are enjoying their period in the sun, is our greatest enemy.