Una vez se actualice lo puedo ver en Tikr:

Ah! ¿pero sabéis que hayan comprado o no? Igual me estoy liando yo solo.

No he visto ninguna noticia al respecto.

Disculpa he entendido mal.

Culpa mía, he mezclado dos temas diferentes ahí.

Lo que quería decir es que Turtle son de los que compran abajo y van vendiendo arriba.

Pero en acciones europeas es difícil verlos.

Respuesta de TRESOR Capital sobre invertir en Turtle Creek a través de ellos…no lo veo

"We aim to take on clients with a minimum amount of EUR 100.000 investment. While it is possible to invest through us in the UCITS fund, it is advisable to do this via your own investment account for amounts below EUR 100.000. As it is a UCITS fund, this should be available to you.

Regarding the fees, we charge a 1% management fee on our end. If you’d invest through a corporate account, you are exempted from VAT. Then there are costs for the custodian (0,125% per annum), and one-off subscription costs which amount to about 0,2%. The costs from the Turtle Creek Investment Fund are paid from the fund’s assets, so are only implicit. The long term returns of the fund are net of all the fund fees.

The next steps would be to open a bank account with our Swiss custodian bank. It’s a tripartite agreement, one between you and the bank (to open the bank account) and one between you and us (to formalize the investment strategy etc., which would entail investing in Turtle Creek). You’d fill out the paperwork in the name of the entity that would be the investor (either a corporation or your own name if it’s a private account) and the bank account would be opened in that name (of course we’d need some additional information to prepare the paperwork, such as the UBO, proof of address, and the like). That includes a limited power of attorney for us, providing us the mandate to invest in Turtle Creek on your behalf. "

Veo comisiones por todas partes. MUY CARO.

Mejor coger y replicarlo que invertir con tanto intermediario.

Una solución sería crear una SL fuera, e invertir a nombre de ella, para que no entre la regulación UCITS a prohibirnos.

Pues imagínate: la comisión del fondo en sí, más 1% de Tresor, más…inviable.

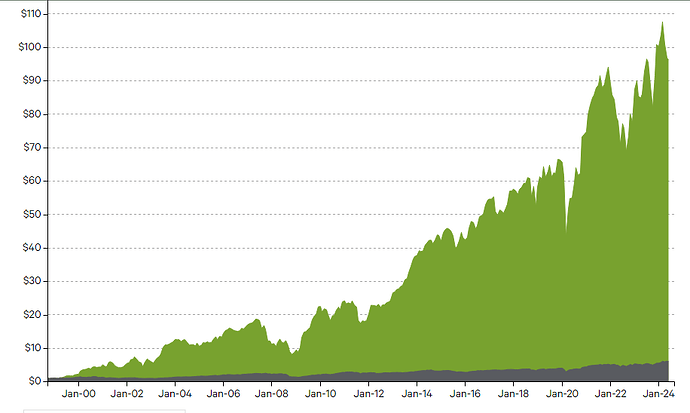

Eso sí, la rentabilidad a 25 años no tiene nombre. Aquí en el Bananero seguimos con los Sabadell Prudente, etc…una pena. Suerte que unos cuántos al menos, nos hemos “revelado”

Jeld-Wen no para de bajar.