Spotify by TMF

's 2021 Outlook Is Nothing to Worry About

Adam Levy February 12, 2021

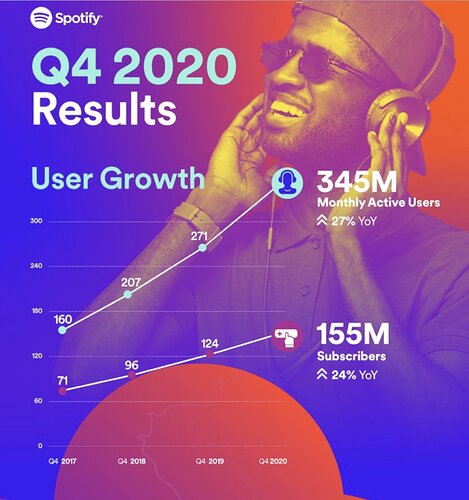

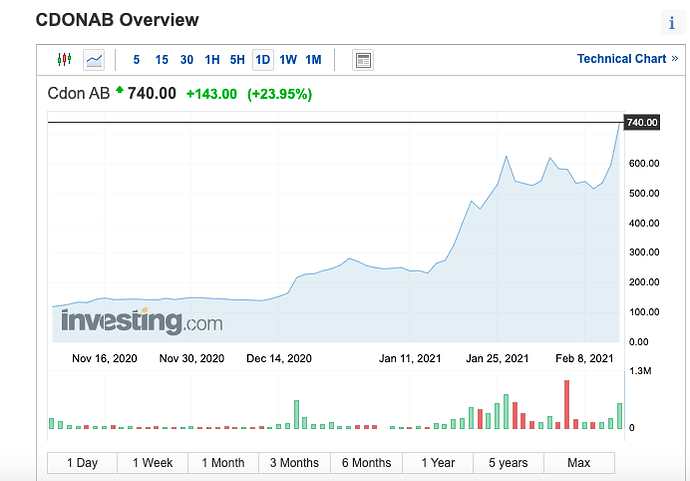

Spotify (NYSE: SPOT) beat expectations with its fourth quarter results for listeners, subscribers, and earnings. Still, investors sent the share price lower following the report on management’s weak outlook for 2021.

The company expects to generate 2.09 billion euros at the midpoint of its outlook for the first quarter of 2021 and 9.21 billion euros for the full year. Both are below analyst expectations by around 5%. But investors, especially long-term investors, shouldn’t worry about the weak outlook for the high-flying media stock.

Image source: Spotify.

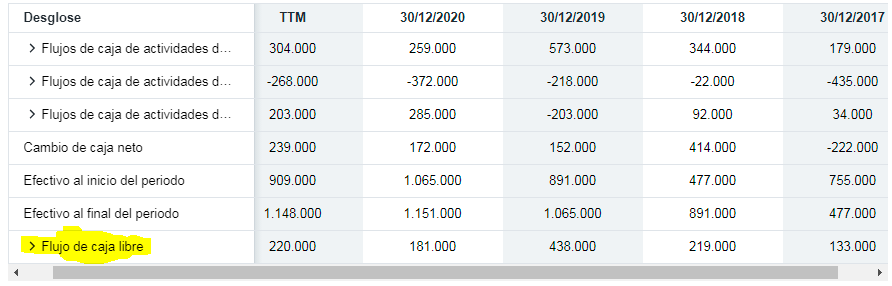

Spotify’s history of financial forecasting

Spotify historically does a pretty good job of forecasting its revenue results, but has always erred on the side of caution. In 2018 and 2019 the company produced revenue right at the top end of management’s guidance. It missed revenue in 2020, but that was due to the negative impact of COVID-19 on its advertising business.

| Year |

2018 |

2019 |

2020 |

| Outlook (in euros) |

4.9 billion-5.3 billion |

6.35 billion-6.8 billion |

8.08 billion-8.48 billion |

| Actual results (in euros) |

5.26 billion |

6.76 billion |

7.88 billion |

Table source: Author. Data source: Spotify press releases.

I bring this up because Spotify is historically conservative with its guidance. And going into 2021, it has reason to be even more conservative. There are just a lot of unknowns for Spotify right now.

During Spotify’s fourth quarter earnings call, CEO Daniel Ek reminded analysts it only forecasts “what we have a very high degree of certainty that we will achieve.” He went on to say, “Given the uncertainty we face today, I suspect that our full-year 2021 plan will have a higher variance than prior years. Therefore, what you see reflected in the forecast is what I believe we will absolutely do.”

In other words, the 2021 outlook is pretty much the floor of what investors should expect from Spotify this year. That said, Spotify will have to exceed the high end of its guidance in order to meet analysts’ original expectations, but that’s certainly doable.

Factors to consider for Spotify in 2021

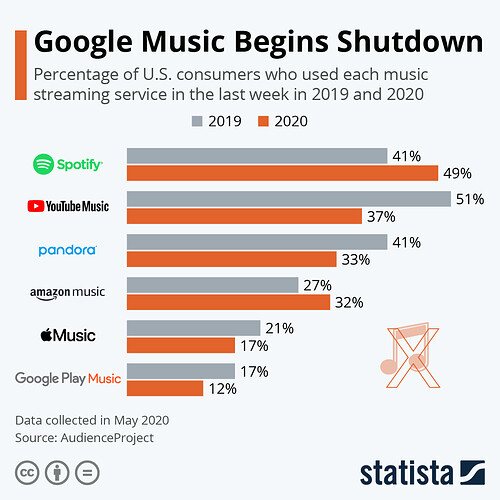

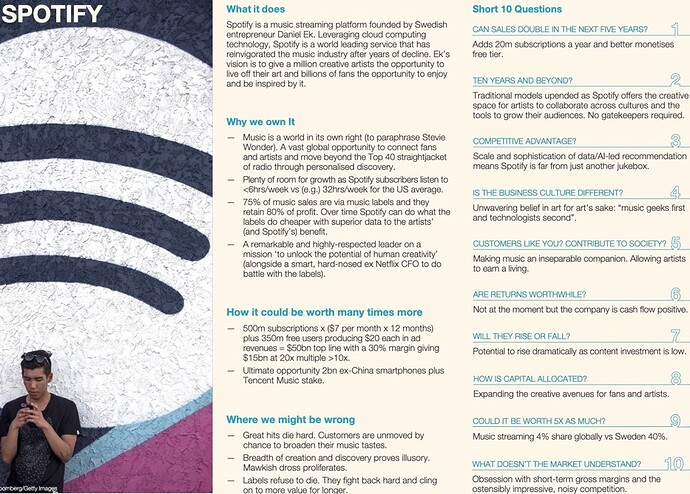

Ek pointed out there are three main ways Spotify can grow revenue: improve product composition, expand the user base, and increase pricing. The company will do all three this year in order to grow, whereas it previously relied on just the first two.

Improving the product composition means shifting more users from its ad-supported service to premium subscribers. It ended 2020 with 45% of listeners paying for a subscription. That’s a decrease from 2019 when 46% of listeners subscribed. Ad-supported listener growth also outpaced subscriber growth in 2019, so it’s not a trend isolated to the pandemic. However, Spotify says it’s seeing positive results with podcasts converting more listeners to paid subscribers. And it could focus more on converting free listeners to paid subscribers in maturing markets.

Growing podcast listening is another means of improving product composition. Scaling the podcast business offers greater revenue and profit potential than music listening. Where Spotify’s contractually obligated to share a percentage of revenue, it can keep 100% of revenue from ads sold by its own podcasts. Additionally, it generates revenue from both paid and free listeners on podcasts.

Spotify will continue to grow the listener base in 2021 as it expands to new markets and penetrates existing markets. Management was conservative in its outlook for user growth as it believes the pandemic pulled forward some listeners from 2021 into 2020. It also launched in Korea earlier than originally planned, pulling forward subscribers in the new market.

Finally, Spotify will start to raise prices in select markets this year. It started testing a few markets late last year, and Ek says the early data in those markets is positive. It increased prices in 25 more markets at the start of February, and management doesn’t expect the price hikes to have a material impact on subscriber retention. Strong results in those markets in the first half of the year could lead Spotify to increase prices sooner in other markets.

There’s a lot of potential upside for Spotify to grow in 2021. If its outlook can be considered a floor, investors will see revenue growth of 14% to 19% this year. With those expectations baked into the stock price now, investors could see a nice bump in share price sometime during the year as we gain more clarity on the impact of all the changes going on at the streaming media business, the advertising industry, and the world in general.