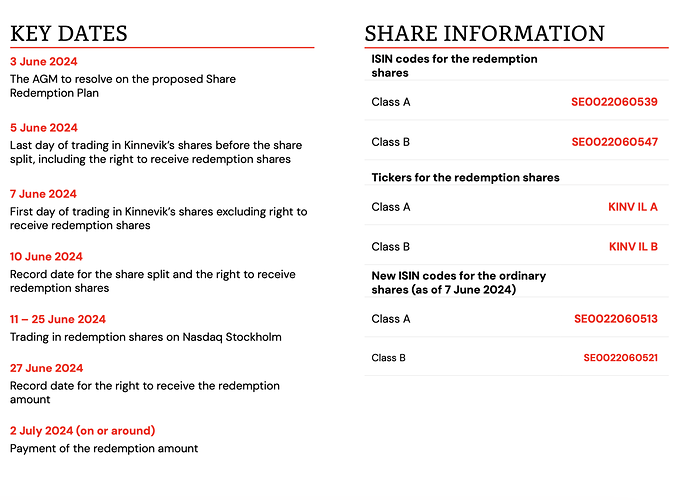

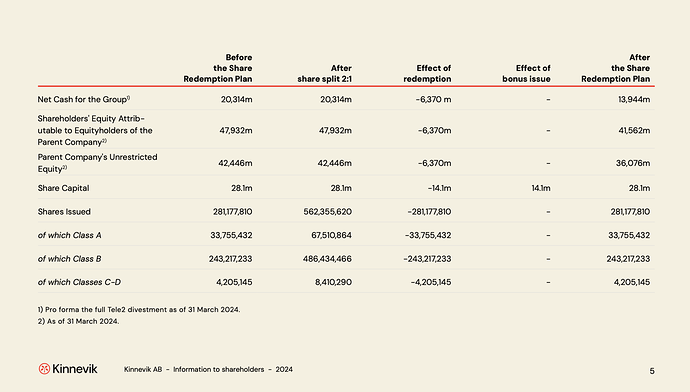

Under the proposed Share Redemption Plan, each ordinary share of Class A and Class B in Kinnevik will be split into two shares, of which one (1) will be a redemption share and one (1) will be identical to the current ordinary share that was split, i.e. an ordinary share of Class A or Class B as applicable. In the shareholders’ accounts, the redemption shares will be referred to as KINV IL A (Class A redemption shares) and KINV IL B (Class B redemption shares).

Redemption shares of Class A and Class B will be traded on Nasdaq Stockholm during the period 11 – 25 June 2024. How- ever, trading in the redemption shares during this period is optional. It should be noted that for shareholders outside of Sweden, no Swedish withholding tax is normally imposed if the redemption shares are sold on Nasdaq Stockholm.

Thereafter, all redemption shares will automatically be re- deemed by Kinnevik (i.e. no action will be required from you as a shareholder in Kinnevik in order to receive the redemp- tion amount), and on or around 2 July 2024 the holders of redemption shares of Class A and Class B will receive a re- demption amount of SEK 23.0 per such redemption share.

Kinnevik shareholders whose shares are registered with a nominee (for example a bank or other securities company) will receive redemption shares and the redemption amount in accordance with each nominee’s routines.

■ Split of each Kinnevik share into two shares (share split 2:1), of which one (1) will be a redemption share.

■ Reduction of the share capital through redemption of the redemption shares.

■ Increase of the share capital through a bonus issue.

■ Amendments of the articles of association to adjust the

number of shares to the Share Redemption Plan.

Class A or Class B redemption shares held in treasury as well as redemption shares of Class C 2021, Class C 2022, Class C 2023, Class D 2020, Class D 2021, Class D 2022 and Class D 2023 will be redeemed by Kinnevik, however no redemption amount will be distributed to the holders of such redemption shares, instead an amount corresponding to the quota value of such shares will be transferred to Kinnevik’s non-restricted equity.

Por lo que veo parece una reducción del capital. Como un dividendo extra sin pagar impuestos. Claro, hasta que Hacienda sea notificada de la operación…

¿Sería algo parecido a una recompra de acciones para amortizarlas?

Aquí se amortizan, pero no veo luego la recompra.

Es algo que no había visto en 25 años todavía.

Si una reducción de capital directa:

Una reducción de capital es una disminución de la cifra del capital social de una sociedad que realiza con alguna de las siguientes finalidades: constitución o incremento de la reserva legal o reservas voluntarias, restablecimiento del equilibrio entre el capital y el patrimonio de la sociedad disminuido como consecuencia de las pérdidas, devolución de aportaciones a los socios y condonación de dividendos pasivos.

Las acciones se me han dividido en dos. Unas, los derechos a 2,03€ cada uno, y el resto las acciones, a 8,87€ cada una.

Imagino que las primeras se venderán en el mercado, y las segundas nos las quedaremos.

Quedarnoslas con ruina asegurada.

En fin…

En Investing veo dos acciones diferentes de Kinnevik. Unas clase A y otras clase B. ¿Qué diferencia hay @fernando.ledesma ?

Es por la diferencia de votos en asamblea, pero a efectos prácticos, unas han generado derechos que, supongo, se considerará a efectos fiscales, dividendo y otras no.

En renta 4, ahora mismo, unas son consideradas como una spin-off y las otras figuran como alta por canje. Todo esto proviene porque venden Tele2 y quieren devolvérselo a los accionistas, imagino que como forma de compensación por la ‘fiesta’ que llevamos.

El señor Anderson, antes en Scottish Mortgage se ha lucido. A ver qué pasa con esta también, porque lleva buen camino.

A ver si es que está senil. Hace un par de años que no veo ninguna entrevista suya.

¿Te lo imaginas dando órdenes al broker desde la Residencia??

Aunque Munger también estaba mayor y seguía con la mente ágil cual centella.

Yo también envio ordenes al broker desde la residencia ![]()

Ya nos han devuelto el 25% del valor. Nos quedamos dentro de poco a 0€…

Así pienso. Pierdo 1300 euros, salvo los 200. 1100 al menos de minusvalias. Me quedan ahí 700 euros en 100 acciones que no se si vender en pérdidas y materializarlas o esperar, pero puedo perder todo, a 0.

Las ocurrencias son asi…

Con lo dificil que es meterlo todo en BRYN…

Qué va a hacer, @emgocor?

Pero, ¿la empresa sigue siendo un modelo de negocio bueno y con accionistas de importantes familias suecas pero pasando una mala racha, o dicho modelo de negocio ha dejado de funcionar? Porque la primera opción tiene solución (de hecho en el 2.000 bajó más del 90% desde máximos a mínimos y luego superó esos máximos) , quizá cambiando al CEO, pero lo segundo…

Tengo 1.000€ en Kinnevik. Voy a liquidar poco a poco todas las posiciones pequeñas. La venderá en un corto-medio plazo.

Sigue igual de siempre, pero no vemos que la entrada de Anderson haya servido para nada, y menos para revolucionar la compañía.